- Installments: Pay in multiple equal payments — typically 3, 4, 6, or more — often interest-free for short terms.

- Invoice-based payments: Receive goods now, pay after a delay.

- Direct debit (postpaid): Full payment is auto-debited later.

- Monthly financing: Spread payments over several months with minimal or no interest.

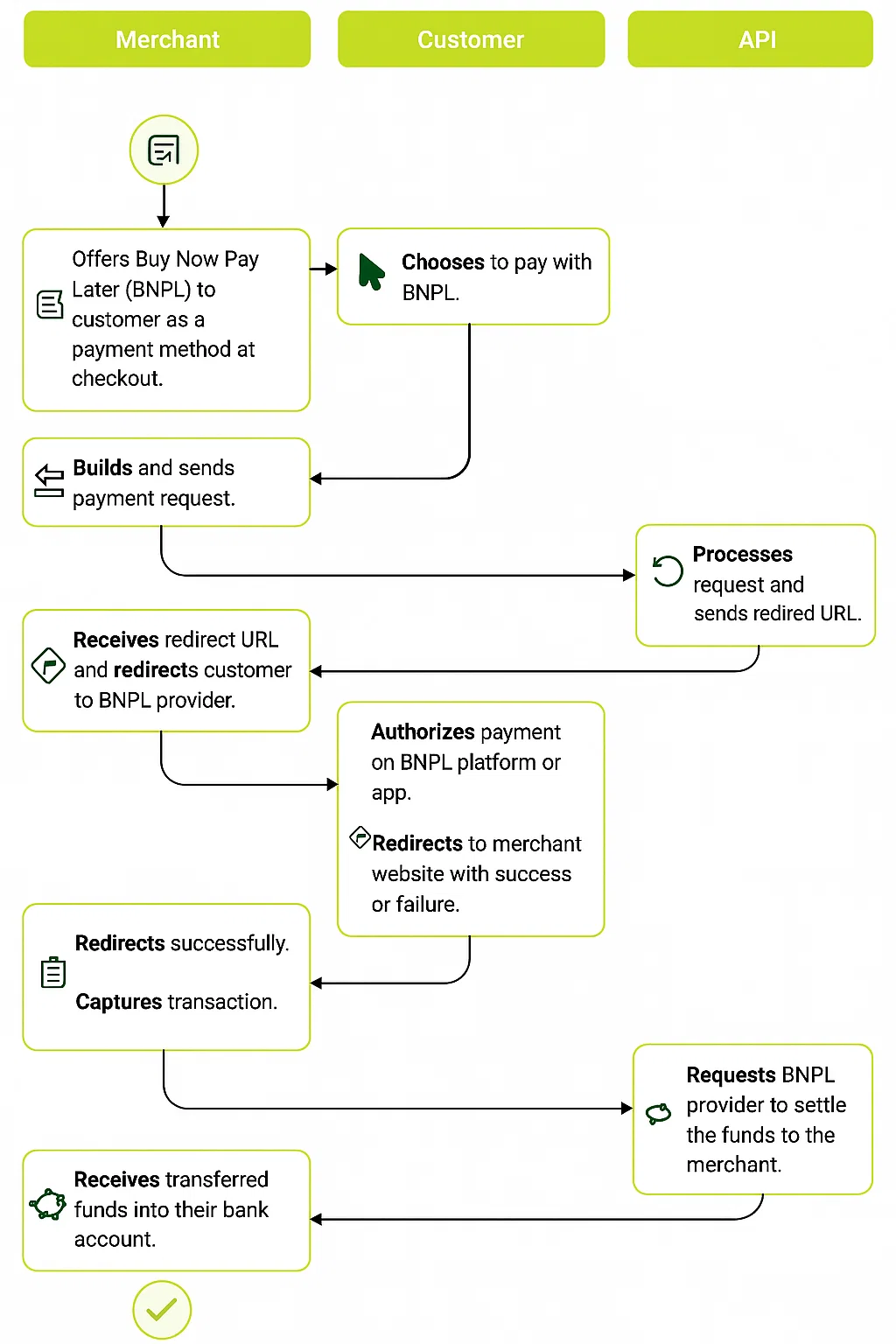

How BNPL Works

BNPL simplifies the buying process for both shoppers and merchants. Here’s how a typical flow works:- Customer selects BNPL at checkout.

- The BNPL provider performs instant approval, often via soft credit or identity check.

- Merchant gets paid upfront by the provider.

- Customer repays the BNPL provider according to the selected payment schedule.

Why BNPL is Transforming E-Commerce

BNPL is a game-changer for merchants:- Boosts conversions: Customers are more likely to complete purchases when they can pay later.

- Increases average order value: BNPL users typically spend 30–50% more per transaction.

- Attracts new audiences: Particularly younger shoppers and those without traditional credit.

- Supports global growth: BNPL adoption is rising fast across North America, Europe, APAC, and beyond.

BNPL is projected to power over 25% of global e-commerce by 2026.

The BNPLx Advantage

With BNPLx by GreenBanana Group, you get all the benefits of BNPL without the integration hassle:- Single API to access multiple BNPL providers.

- Plug-and-play plugins for WooCommerce, Shopware, and more.

- Unified dashboard to manage payments, performance, and provider insights.

- Full support for all BNPL types — from invoices to installments to financing.

BNPLx is built for flexibility — one integration, many providers, and global support out of the box.